I feel that “outgroup dumb” is shitposting but it’s from a real poll.

https://today.yougov.com/politics/articles/5057-understanding-how-marginal-taxes-work-its-all-part

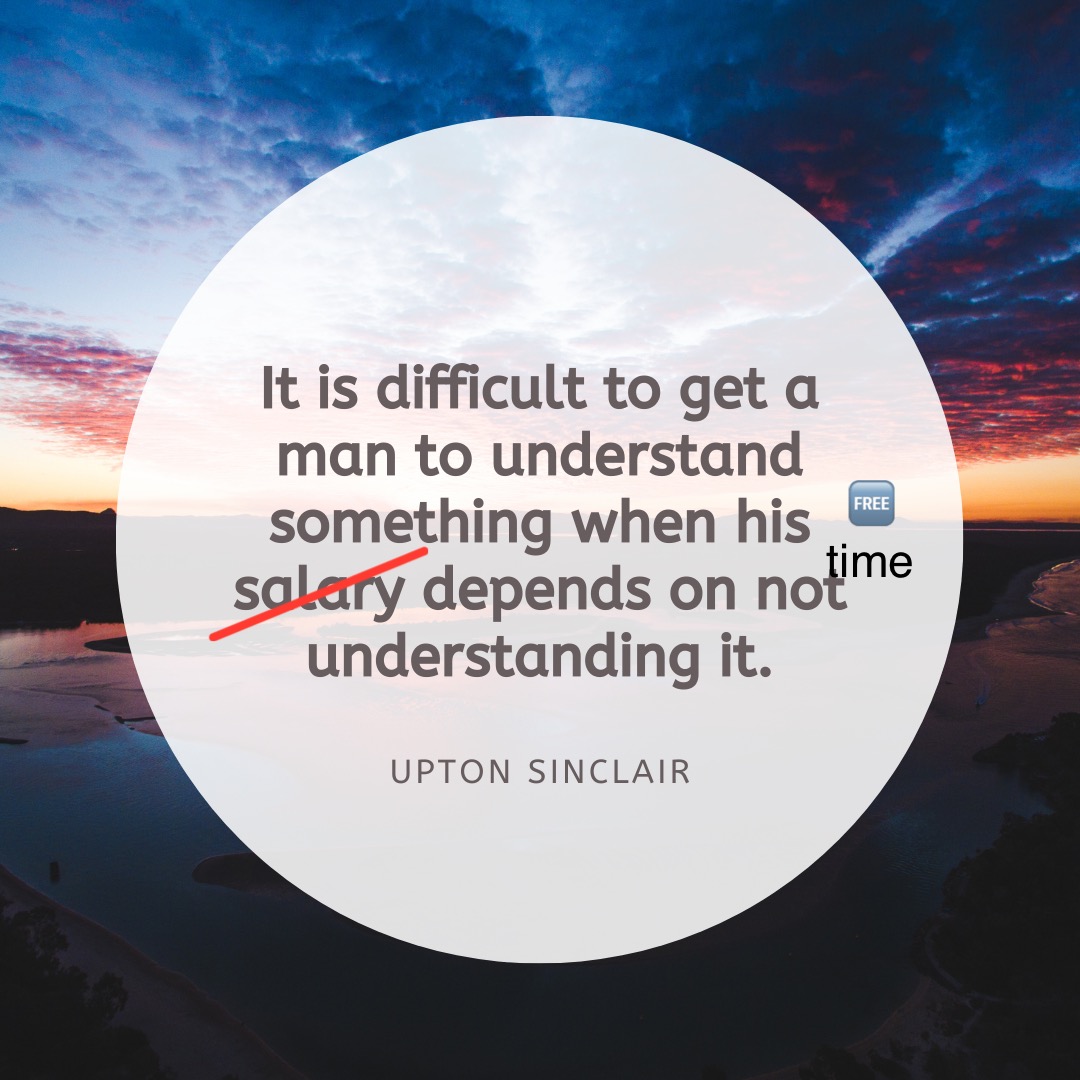

If you ever wanted proof that a population that doesn’t understand math allows the billionaires to take advantage of them here it is. This is why education systems are under attack, because if you understood how taxes work you’d more likely support higher tax rates for the rich.

I think this is at least partially the result of intentional propaganda. It benefits the elite greatly if a lot of Americans are screaming against higher top tax rates due to this faulty logic. There are also a lot of anecdotes of people not accepting higher paying job offers or promotions within their company, which also benefits the business owners.

https://youtube.com/shorts/-621rVJvUdY

Mr. “Population collapse is the biggest threat to the world.”

Maybe it’s just the biggest threat to capitalism and your ROI. Why do you think he’s supporting the make everyone dumber party?

deleted by creator

If you ever wanted proof […] here it is.

Yes! Well yes but also no but only because…

@General_Effort@lemmy.world I always do the web search when OP didn’t happen to think about linking a source but this is egregiousDANGIT IT’S A SHITPOST I AM SO SORRY

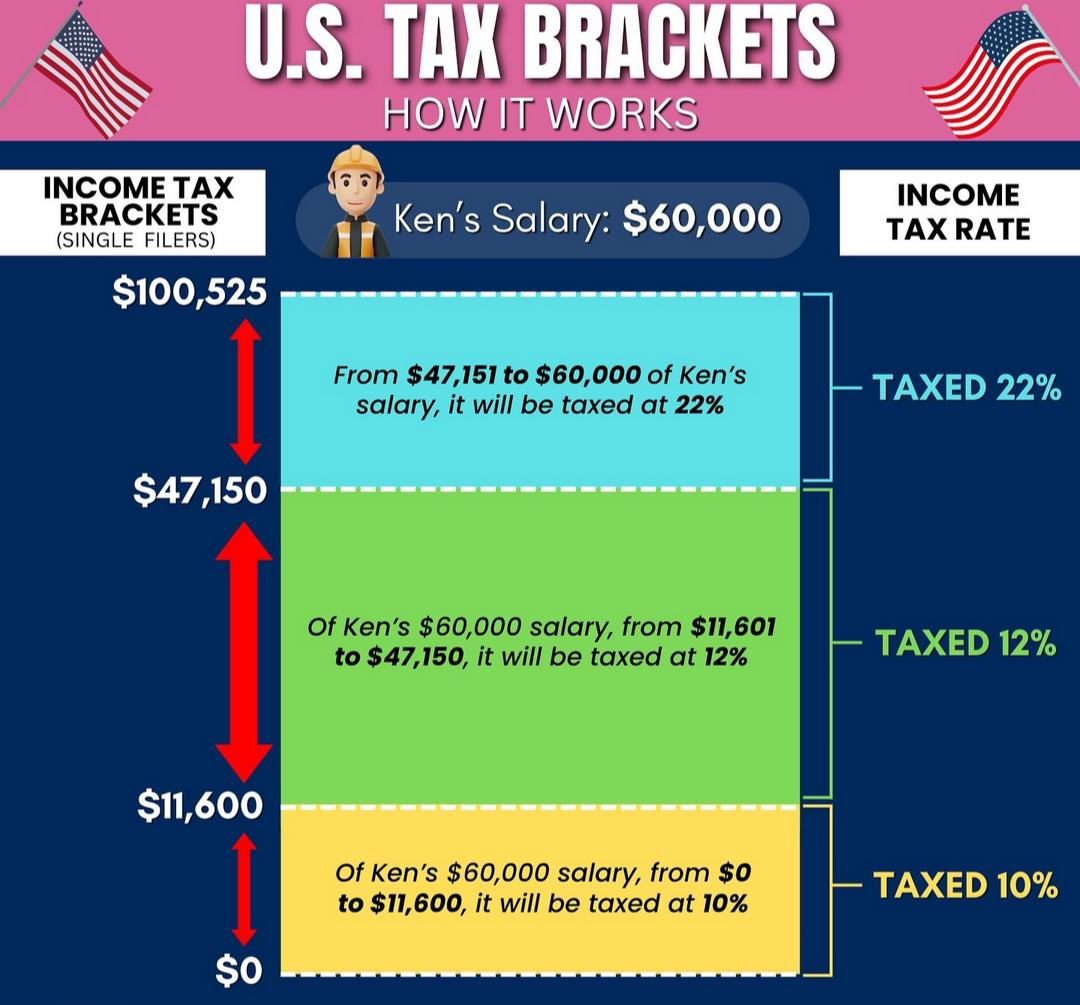

To be clear for those unaware, you pay the lower bracket rates for the amounts earned in that bracket and the higher bracket rates for the amounts earned above that bracket.

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

This is actually not true as it doesn’t take into account the standard deductionRead the chart, it says taxable income.

Deductions and other tax games may lower you’re taxable income, but the progressive tax brackets apply this way to all taxable income.

I upvoted because you chose to strike thru rather than delete. Big props for that

I try to be accurate. Hence why the comment in the first place.

Agreed, I love people that own their mistakes.

It does not take into account a lot of things, namely the many many deductions for qualifying individuals.

Not all people take the standard deduction, this is true before all deductions and similar economic stimuli.

This is the problem. My partner doesn’t want to work OT because he thinks it will cost him more in taxes. I explain why that’s not exactly true, but I can tell he’s not interested. Financial Literacy in the US is abysmal.

Your partner is a moron who doesn’t understand relatively simple math.

Nah. He’s not an idiot. But he is impatient. He doesn’t handle paperwork or anything involving patience well. (ADHD)

I also think taxes in the US are intentionally over complicated and confusing. I don’t struggle with things like that but I can empathize with people who do.

Strictly speaking the taxes in the US are not that complicated, but the credits, deductions and what not are. Still Tomato Tomato.

I too have ADHD and am impatient (combined type, severe). Impatience is not an excuse for financial illiteracy. And a graduated income tax is not complicated. Deductions, credits, exceptions, etc are where it gets complicated. But if he thinks he’s losing money by making more money, then he’s stupid.

Reading your other responses, you’re right. Not knowing something doesn’t make someone stupid. Refusing to learn something when you find out you don’t know it, that’s what makes someone stupid. Willful ignorance is stupid.

At the very least, he should just admit he knows nothing about it and just take your word for it. Deferring to others expertise in areas you are weak is smart.

have you considered asking him why he even thinks that in the first place? You’ve literally put him into a spot where he’s too stupid to even care about whether or not that response is logical or makes sense.

If he just doesn’t want to work overtime that’s fine, a lot of people don’t, why would he justify it with stupid tax logic that he evidently must know is stupid? Seems like cope to me.

You cannot simultaneously “be smart” and then “be stupid” you are either stupid about something, or not. It’s one of the two. I’m sure he’s a pretty generally smart guy, most people are, but either it’s an excuse he uses because he doesnt want to work overtime, or he’s literally uneducated (and therefore stupid) about taxes, and chooses not to be educated about it, even though it would be financially beneficial to him, because that’s literally how money works. (which would also make him pretty objectively stupid in that case) again, he may not care at all, but then why wouldn’t he just be upfront about not caring?

I would disagree with your premise but it’s not your fault. It’s my fault for not explaining it clearly

I don’t think not knowing something makes you stupid. Humans can’t know everything. We all have strengths and weaknesses. I know about taxes, but I don’t know shit about cooking. He cooks dinner, I deal with the bureaucracy situations.

Also, I’m don’t know if you’ve ever spent time with someone who struggles with ADHD and Neurodivergence but their brains don’t work like others. They can’t force themselves to do things that other people can tough out. They can study all night but if their brain can’t stay on track, they won’t be able to retain it.

When I come along and start telling him how tax brackets work, especially if he didn’t ask me, hes going to be frustrated and he’s not going to get through it easily.

I don’t know if he just doesn’t want to work OT and has settled on this excuse or if there is some other issue but it doesn’t matter. If he doesn’t want to work OT, that’s okay!

I would disagree with your premise but it’s not your fault. It’s my fault for not explaining it clearly

TBF, i was being a little unreasonably harsh, but i was trying to make a point off of minimal descriptive language so i don’t really have much flexibility there.

I don’t think not knowing something makes you stupid. Humans can’t know everything. We all have strengths and weaknesses. I know about taxes, but I don’t know shit about cooking. He cooks dinner, I deal with the bureaucracy situations.

Personally i think being stupid isn’t necessarily a bad thing, it’s just a lack of education, but i think what really matters is whether or not you weaponize it, if you don’t know anything about that topic, you would be relatively stupid in that space, however if you acknowledge that you know nothing and have no practical knowledge basis, that’s fine. It’s when you know nothing, know that you know nothing, and still engage with it even though you know you have a limited basis to act upon, that it’s a problem.

Also, I’m don’t know if you’ve ever spent time with someone who struggles with ADHD and Neurodivergence but their brains don’t work like others. They can’t force themselves to do things that other people can tough out. They can study all night but if their brain can’t stay on track, they won’t be able to retain it.

believe me, i understand it, i’m very ADHD coded, but that usually means i just never get around to doing the things that i need to do (which is relevant here) i don’t normally make up weird tangentially relevant reasoning to cope about why i don’t do those things though. Personally i find very directed note taking helps a lot with retaining, and it acts as a cheatsheet for when you do inevitably forget about it later on. Though it still requires researching it in the first place.

When I come along and start telling him how tax brackets work, especially if he didn’t ask me, hes going to be frustrated and he’s not going to get through it easily.

there could be a few reasons for this, ignoring external influences, like being pre-occupied, you’re either going to have a problem with explaining it, and you need to alter the explanation so it’s easier to comprehend, or you’re going to have a problem comprehending it, but tax brackets are pretty conceptually simple from my understanding. It should take like 2 minutes to explain the concept of tax brackets to someone, obviously filling them in on all of the details takes longer, but it’s the relevant part here.

If you aren’t capable of digesting that level of explanation, i’d be concerned about either your level of intelligence, or your ability to care about things. If you aren’t capable of caring about something as important as finance, and relatively simple as tax brackets, i’m not really sure what you’d be capable of even conceptualizing in the first place. In my mind, that’s either weaponized incompetence, or you have a significant learning disability/developmental disability, as an adult. Which is something that should probably be addressed, obviously i’m not at liberty to talk about any specific person here, but i would personally be pretty concerned by that. Even as someone who struggles with this kind of stuff.

I don’t know if he just doesn’t want to work OT and has settled on this excuse or if there is some other issue but it doesn’t matter. If he doesn’t want to work OT, that’s okay!

Yeah, again not wanting to work OT is perfectly fine, but if that’s the reason i’d be confused as to why he’s using an irrelevant topic to excuse that, instead of just being upfront about it, seems weird to me on face value. The other option is that he seriously believes what he’s saying, even with you correcting him, which means he doesn’t trust you, even though you would be the one filing the taxes, which is also incredibly weird. Even if you try explaining it to him, it doesn’t seem to matter, so i’m not really sure what the deal is here, but it’s weird. Like you see what i mean here right? This doesn’t really check out logically in any significant capacity. Granted, it’s possible you’ve left out relevant details that would impact that, but i’m just basing this off of what i’m reading so there’s that for take it with a grain of salt.

Regardless of this specific event, it’s probably going to influence future recurring behaviors, so it’s something to think about. Generally it’s rare that people latch onto a specific mechanism of behavior for one, and only that one thing, it usually applies to other things as well.

There’s not enough information provided to reach this conclusion.

There is very much enough information given to reach that conclusion.

No, there is not. There are many tax credits one is no longer eligible for after a certain threshold. There are various programs one is no longer eligible for after a certain threshold.

Most of the likely credits tend to phase out gracefully. So it’s true that we can’t be certain, based on my experience of when people are afraid of making too much money, it’s almost always because they think a higher tax bracket applies flatly across their income not due to nuanced understanding of tax credit and welfare benefits.

This is true for many people I’ve talked to, but he does understand, on a basic level, how the brackets work. When it comes to the calculation parts, I think he gets frustrated with all the rules.

But it’s okay! I’m good at stuff like that and he can build pretty much anything. We all have our strengths. :)

Hellllll yeahhhh!!!

Yooo is he visual?

Awww I thought for sure we were gonna have the perfect diagram thing…

Bah. So maybe there’s some YouTube video where they’re like “Bob made $50,000 last year. This year he took some extra construction shifts and made $75,000. …”

I don’t care about the partner’s weaknesses I demand clever solutions :p hehe glad everything is good!! 💙

Edit with silly riff that’s probably inaccurate:

I’m kiddddding this was just the evil thought when I first read it :p

This is not a US specific issue, tbh. I’ve heard this weird belief repeated by all sorts of people.

You’re absolutely right. I cant speak for anyone else, as I don’t live there but I highly doubt the US is an exception.

Rather than being mad at each other, I want to make sure we hold the right people accountable! Governments, corporations, billionaires etc.

It’s a form of oppression.

I’ve heard it in Australia too, which has the same tax bracket system as the USA. I think the fact that this stuff isn’t taught in school is a major issue.

it is a misinformation many people in power wants to keep because it lets republicans sell their policies to not tax the rich and bosses to not raise their employee’s salaries.

Oddly enough it kinda does. OT can make you pay out more taxes on that one check since withholdings are calculated by check. Basically the government/payroll system thinks you’re going to be making that every week so more taxes will be taken out.

In reality this only effects the size of your tax bill or return at the end of the year.

That’s what people see and exactly why they think they got kicked up a whole tax bracket.

The whole notion of “kicked up a tax bracket” is also a misleading thing. Only a piece of your income goes into the “new bracket”, all pay under the new bracket is taxed as they would have been used to.

Exactly, and it also depends on what withholding you have requested.

“you can’t make less money by making more money”

Unless you’re poor enough to be on welfare. The Welfare Cliff is awful.

This can also apply to student loans when one person makes a lot more than the other.

Run, if it’s not too late.

Nah. He’s not a bad person or a dummy. He just gets frustrated by bureaucracy and doesn’t have the patience I have.

It’s not the fear of bureaucracy that is concerning, it’s the lack of interest to listen to your sound advice on a relatively simple topic.

That’s fair. I appreciate your concern for me!

He’s not always like that. I didn’t mean to make him sound like a jerk. I just meant to relate to the topic of tax confusion with personal experience.

He had pretty severe ADHD and struggles with some topics. It’s okay! I deal with the money stuff and he cooks dinner. :)

Fair enough. Good luck on your journey!

You too!

We all have our weaknesses and faults. No need to dismiss every relationship due to imperfections.

Nah. There’s good people here and even the people who voted for this deserve to have their needs met, many of then are only personally responsible for a tiny fraction of the immense harm caused by the systems of power. And they may not have caused any harm in the first place if they lived in a place where people are always taken care of as well as is reasonably possible. there is immense pressure to shed empathy and embrace individualism and forego the many benefits of community such as efficient and effective collaboration, for example to prevent a disease from spreading or at least reducing the harm it causes. As many of us can see, especially obviously in the US, the goal and function of the system isn’t actually to stop causing harm in the first place, or even reduce the harm that must be caused for your society to function, the cruelty is often very much the point. Non-absolutely essential needs are less and less profitable to meet the less common it is to have the need, and the amount of wealth that can be extracted from the people with whatever need is the only thing that really determines what gets things done, and subjugation and not giving folks a chance to think critically and question their circumstances by completely overwhelming them with horrible information (including dis- or misinformation) about the world and making them think they’re threatened by whoever is opposing efforts to make line go up. Most folks don’t stand a chance without direct intervention and time spent with someone directly affected by the system in an obvious way, including possibly the person themselves.

At the very least I owe it to my family to stay and be as helpful as possible to the people who have supported me and hopefully others who don’t deserve what’s coming if a major effort of community organization doesn’t happen

Tbh, literacy in the US, financial or otherwise is abysmal right now.

it’s just not the US. I live in the Netherland and many people here think OT and bonuses are taxed differently, because they see a higher tax rate applied to it on their slip. They forget that their base salary covers multiple brackets and a tax credit. Thus has a lower average tax rate than their OT and bonuses which falls in their top bracket or even a bracket above.

By design

No, they teach you this in high school. These people are just dumbasses

Yes, everyone’s education is the same as yours.

Yeah, I definitely didn’t leave this in school. I know about it from reading articles on tax brackets. _(‘’)/

deleted by creator

I think you’re on the wrong side of the chart here.

Or the person calculating their withholding was. But if you’re paycheck to paycheck then that paycheck amount is all that really matters. Cool, I get a bigger refund eventually, but I’m now choosing between eating, walking 2 hours to work to save gas, or letting a bill go unpaid.

That’s not how is works though.

I’d you made say 1500 normally and 2000 with ot your take home could be 1200 and 1400. Paying more taxes overall on the ot but still taking home more.

There is no way you’d take home less money because taxes are paid on the first $1500 @ $300 and say the next $500 @ $300 too at a higher bracket. Overall your pay is still higher though even though your taxes “doubled”.

deleted by creator

That’s not how it works though. Unless you didn’t work regular hours during that same time period so worked less overall OT is taxed higher upfront so you don’t end up owing (more), but would never decrease your pay

deleted by creator

I’m more concerned about the third of dems who don’t understand this.

it’s in the shitpost community and there’s no sources cited

My tired brain read your comment as “shitpost economy” and somehow that still made sense to me.

Oh

I feel that “outgroup dumb” is shitposting but it’s from a real poll.

https://today.yougov.com/politics/articles/5057-understanding-how-marginal-taxes-work-its-all-part

I used to be a supervisor at a psych hospital and had to regularly explain this to staff who were refusing overtime. They wanted to do it, sometimes desperately so because they needed the money, but they were utterly convinced that once they crossed 40 or 45k or whatever they would be taxed higher and make it all pointless. I felt like some just didn’t want to do ot, which was fine, but some legit keep meticulous records of their earnings to ensure they wouldn’t go over the line. I swore to them it didn’t work this way but they never believed me

Should print out a poster infographic explaining progressive taxation and put it up on the wall in the break room

Yeah I am pretty sure they wouldn’t understand this either

This infographic is kinda bad and would not convince someone who doesn’t know how it works at all

But you have to keep it going to highlight how much wealthier people pay (although that’s tougher since their income is not “income”). Maybe throw in a few examples of the wealthiest Americans and wha recent age they pay, to not only clarify it, but retarget their anger where it belongs

Would have to be mandated by workplace regulations, no company is going to voluntarily educate their employees that more money has no downside.

I’ll also say this doesn’t help, it strangely avoids the actual numbers. It should state explicitly that his total taxes would be $1,600+$4,266+$2,827=$8692, and not $13200. Needs to include the scenarios specific results and contrasted with what the viewer would have assumed otherwise.

Seen the same bullshit when I worked retail. Nothing will convince them.

It’s easier to trick someone than it is to convince them they’re wrong.

I wonder how different the planet would be if boomers had just been taught, from an early age, that it’s OK to be wrong.

I remember my mom saying something like “don’t believe what you see on tv and only half of what you read.” Yet here we are.

Yeah, I remember my parents teaching me a whole lot of shit that Fox News would call “woke” today. I’m just thankful that I grew up when I did, because if it were now I’d probably have died of measles.

deleted by creator

We covered how taxes are calculated at school, it isn’t very complicated. Yet SO MANY people insist they end up getting paid more it made me question myself for a while.

Although sometimes the removal of certain benefits does mean people can be worse off for £1 extra. Which if anything is just a sign that the benefits were poorly thought out and should taper off instead of being a hard limit.

There is probably sticker shock involved. Someone who gets a raise will see a new amount of taxes witheld and may be upset. It could even be they didn’t know what the amount taken out before taxes was.

The only way that’s a problem is if you’re on certain government benefits, if you make just a little bit too much there’s a hard cutoff for many benefits so you may end up losing more than you made in OT. But if your staff is facing this dilemma, they need to be paid more.

Pay them more? So they can lose their benefits? Are you crazy?

I’m kidding, of course. I know that what you mean is, “pay them so that they can afford to live without requiring benefits.”

You get into some of the poorer places in the country though, that truly would be nearly impossible for most businesses. There are some places in West Virginia that would immediately have no access to gasoline, groceries, etc.

It is crazy to think that Bobby McBusinessman gets to ride around in a giant RV all summer because the government pays his employees. They don’t see it that way though, as they collect their HUD payments and accept food stamps while all of their employees receive food stamps and medical benefits.

All while the rest of the community lives on nothing and experiences very little joy in this life.

What do I know though? I’m just a pissed off hillbilly who helped make someone who isn’t me very rich.

Short of doing a demo with rolls of change or MnMs or something, asking people to conceptualize math that is not just simple addition is often asking too much. Especially when people’s financial literacy is learned at home from people who retired in 1996.

Well look where we are, trump loves the uneducated, they got his thieving rapist ass elected.

every day, my theory that people are just willfully retarded gets proven more and more correct. Even with the tools at the disposal of the modern internet savvy person, nobody tries ANYTHING to verify ANYTHING.

It’s actually so fucking depressing and i think humanity is joever at this point. I’m not sure how you recover from this point effectively.

I mean in defense of these staff: many of them were not amazingly well educated and were pulling 80-96 hour weeks pretty regularly to earn a livable wage. When were they supposed to do this research?

whenever they have to time to do normal people shit? Even slow learning is better than no learning, you can learn a lot over a long period of time if you keep at it regularly.

Perhaps maybe they should spend less time watching their favorite political sock puppets talk about politics, and spend more time actually learning about shit that’s important and matters. Or maybe instead of yelling at people online about their political views, they could spend that time educating themselves instead. Just a proposal.

I don’t know what demographic you think these people were. They were by and large African immigrants. It’s weird that you’ve created this boogeyman version of them in your head though

They would make stuff like jollof rice and share it with everyone. Super nice people. The only politics they ever brought up was one guy I got to know well would talk a lot about how the elections in the Congo at the time (2010ish) were rigged and the leader at the time was concentrating his power; that war was inevitable if someone did not intervene. He apparently was right because the m23 has been going off there, though admittedly I don’t know the full scale of the situation

are we talking about a specific demographic of people? It’s possible i missed that, but i figured this was a generalized thing.

Oh see I was continually referring solely those coworkers I had at the psych hospital in my original post you replied to

I mean I’m sure there are people who believe this though who are like trump people or whatever

It boggles my mind how many people who have had to pay taxes for decades even, don’t understand how tax brackets work.

The only time you’ll get screwed on making more is if you were getting some sort of socialized assistance and you make a dollar over the cut off for aid.

Yeah, the Welfare Cliff is the only place where this happens and it’s unconscionable.

It is kind of by design to keep people from trying to get ahead at all

And to keep the private tax filing agencies afloat

try telling this to people who think government agencies pay taxes

Poor Sam

That dude would have been hilarious if he wasn’t really so delusional. Not Sam, he was great. The dude that was convinced that government agencies get tax breaks.

Sam is the GOAT

What? Is this the onion?

One of those rage bait YouTube channels had a young person who made that claim in a debate. Pictured is Sam Seder who was the debate opponent. He made this face at the camera.

That was an entertaining 90 minutes of YouTube! And I definitely saw that face

The channel is Jubilee. The format is that 1 fairly prominent political activist debates 20 people with an opposing position for a few claims the 1 has given beforehand. The 20 swap out who gets to debate at any particular time by voting them out.

I’ll admit it is ragebaity sometimes, but I also find it educational and entertaining. There’s typically about two among the 20 that have gone off the deep end, but everyone else is respectful and appreciative of the opportunity to engage the other side. Also, it does have good fact-checking so the crazies are at least recognized properly.

This is the video the image came from.

They give Nazis a platform. I don’t watch it because of that. Plus I try to avoid rage bait content as much as I can.

you probably stop paying ur isp then

deleted by creator

when did i say that

Thanks

This belief is held by many older folks due to propoganda, and it is passed down to their children when their parents teach them about taxes. Since almost all younger folks use automated tax services, if they aren’t doing the math themselves, the fact that this isn’t true isn’t going to be discovered. I was taught the incorrect way when I was a kid, but noticed that it was wrong the first time I had to do my own taxes. But when I told my parents the way it actually worked, they didn’t believe me until I showed them the .gov site that breaks it down. I grew up in a small, blue collar town, and every single person I talked to about taxes parroted the same incorrect system.

This is absolutely an educational failing. We barely cover taxes in school. At best it’s said once in a class, gets covered in a minor question on a test and if we get it wrong, no one notices. “We” probably still got a B on the test without any CLUE how taxes work.

Yet here we are, dismantling any nationwide effort to make education better.

A LOT of people think 99,999 tax is 27,999 and 100,001 is 29,000, even on the democrat side. If those charts are accurate, it’s probably damn close to 50% of US citizens.

I seriously don’t understand why we don’t have a mandatory class that covers taxes, T4 slips, investing, labour laws, budgeting, reading nutritional information on foods, etc.

The nutritional stuff is like 6th-grade science, about the time you should be burning peanuts with a Bunsen burner.

I’ve seen a few schools that have an elective financials class, but I think they’re still trying to balance checkbooks.

The problem is it’s just one class, and nobody takes classes seriously in high school. Most of them have forgotten the things that they used to know when they were 20, 30, or even 40 years past their education.

It’s like we need some kind of driver’s ed test but for living

edit: 6th grade, no fire in elementary school

I have never been invited to burn peanuts with a bunsen burner. Showing the relationship between chemical energy and thermal energy and the sometimes surprising differences between foods?

I think we had too much separation between diet classes and physical science. I think I recall doing something like a puzzle, with physical pieces, where you tried to make a days food using different foods. The point was that it’s easier and you get more if you pick the healthier foods. Instead everyone knew what the point was and then fucked around making the dumbest possible meal that fit the defined criteria.

I seem to recall the teacher not being amused with my solution that only has one food group per meal. (What’s for breakfast? 9 eggs. Lunch? 3 unseasoned grilled chicken breasts. Dinner? Six baked potatos, plain)Yeah, there’s a lot of lessons in school that we’re not actually ready for. We need some kind of continuing education stuff like they do in the medical profession. When we hit our 30’s and 40’s and our bodies handle food differently, we need those diet courses again. And when we move out of home, we need those finance and home economics classes that haven’t been looked at for a decade.

WTF is T4 slips

Ah, sorry I slipped in some canadian

deleted by creator

It was all covered in my Florida education. For the most part it is just a very small amount of information that people tend to forget it. It also isn’t all taught in one class. (T4 slips are called W2 forms in the U.S. for those questioning). The investing thing is a broad generalization though. I assume because it may get considered an overlap of teaching kids to gamble. Everyone was required to take either micro or macro economics in high school though for us, both of which touched on stock market invement mostly just tied to the idea of a 401k (retirement accounts).

Nutritional labels were covered in science classes multiple times, but we’re touched on in middle school science, and we were all required to take a home ec class for half a year in 7th grade which taught about it as well. Again in physics and chemistry classes.

W2s were covered in our mandatory typing class as a form of data entry, because most people only take the data from boxes off the W2 and enter them into a tax program. Then the tax brackets were taught to us in middle and highschool.

A lot of it to me is that we don’t pay attention in school and forget a lot over time. Nutritional and Tax bracket questions were on both the ACT and SAT. Which are national tests required to get into colleges.

Where i live we have a system where if you take sick days, they are paid 80%. 20% reduction applies only to the days you were sick. Once I got sick at the end of a month and took the last 3 days of the month and first 2 days of the next one off and my mother in law freaked out I’m about to loose 20% of 2 month’s salaries. She was and is still convinced that 20% deduction applies to a whole month worth of salary even if you take one day off that month. She almost never takes sick days and she works in a hospital… She self medicates and works with patients even when she has a transmittable diseases. Best of luck to those who have serious health problems and then get a fucking flu on top of everything from hospital staff. She is 60+ and reading the law to her doesn’t change her mind. A couple years ago she had more serious health problems and took a week off for the first time in decades, even after getting a paycheck reduced only by 5% and not 20% her perception of this issue didn’t change. She misunderstood that system once 40 years ago and she is going to take that misunderstanding to ger grave. Real world has no influence on her beliefs.

That’s the general conservative mindset. It’s why lies work so well on them, get them to believe the lie and they’ll never let it go.

And they’ll also refuse to believe you when you try to explain it to them

How dumb do you have to be? By the time you make that much money you should, in theory, know the answer definitively or have a guy.

Almost everyone has a guy or uses some software. Those two things don’t help them understand and this misconception of how taxes work is but a small sample of how people form political decisions without any viable understanding of the situation they’re in or the repercussions of their actions.

Nobody’s just making out a check for 30% and mailing it off to the IRS.

Hungary used to have a system, which worked like what the republicans imagined, which made “taxing the rich more” a widely unpopular move…

FWIW globally, there is the issue of “welfare traps”. Benefits for low income people are usually tied to income (or savings). Once income reaches a threshold, these benefits must be replaced with income. So a higher income may result in a net loss.

No source?

Don’t need one. The amount of times I’ve had to explain how fucking tax brackets work, I wouldn’t be surprised if the numbers were even more skewed towards the wrong answer.

This is how missinformation spreads though. If something lines up with your existing worldview then you just assume it’s true.

Trust but verify

Lol no. Verify then trust

Oh, you know: Tomato tmahto, potato criptofacism.

For someone outside the American tax system, can anyone put the difference in approximate numbers?

This all boils down to a common misconception about ‘tax brackets’.

To simplify, pretend there’s a 28% tax bracket up to 100,000 dollars, and a 33% tax bracket when you hit 100k. The first 100k is always taxed at 28%, no matter what you make, and it’s only the incremental amount that gets taxed heavier. So here in this example, that would mean tax burden would be 28,000.33 instead of 28,000.28. These are not the exact brackets or percentages, but it’s at least showing the right magnitude of increase versus total amount.

However, many people are “afraid” of bumping a higher tax bracket. They think the tax bill would go from 28,000.28 to 33,000.33. That the tax bracket bumps up all your liability. I remember growing up people saying “I have to watch out and not hit the bigger tax bracket, if I’m close then I need a big raise to make it worth it, or else the raise is going to cost me more than it would make me”. This a big driver of antipathy toward democrat tax policies, a belief that mild success will punish them, despite it only increasing on the incremental amount.

A lot of US benefits have “benefit cliffs” where making $1 more substantially reduces or even completely disqualifies a person from programs like SNAP (food stamps) or childcare subsidies or Medicaid. https://www.ncsl.org/human-services/introduction-to-benefits-cliffs-and-public-assistance-programs

It’s not surprising people whose families are directly affected by, or who know people affected by, benefit cliffs think the lawmakers set up taxes the same way.

True, though if we are talking about tax bracket going over 30 percent, that would be at nearly 200k, so well above those thresholds too. Of course the numbers aren’t 28 and 33, but that is the closest threshold to the example.

To be more specific the first 100,000 isn’t taxed at 28%. The 44 to 100k range would be, but below that will be taxed at lower percentages. The first ~10k you make is taxed at 10%, and then it increases throughout.

If getting specific, there’s no 28 percent or 33 percent bracket, so these are all examples rather than real figures. I did make a comment using real numbers, same general magnitude but just more specific about the brackets.

The first ~10k you make is taxed at 10%

In the USA, technically the first $15,000 (if single) or $30,000 (if married and filing jointly) at least is taxed at 0% due to the standard deduction. If you earn less than that, you can tell your employer that you don’t want any tax to be withheld.

We took a huge hit in our cost of living when we fell off the benefit cliff. I know it’s lost credits rather than more taxes but it doesn’t really matter when you make more and struggle at least as much as before.

German income tax works the same and most Germans get it wrong too. It’s really infuriating.

OK, so it is similar to our system. And would probably in the range of cents or a few dollars then.

In exact numbers, 5 cents.

That one dollar in the 33% bracket has .33 in taxes instead of .28. So their obligation goes up .05 per every dollar in the 33% tax bracket.

Your local tax system probably works the same.